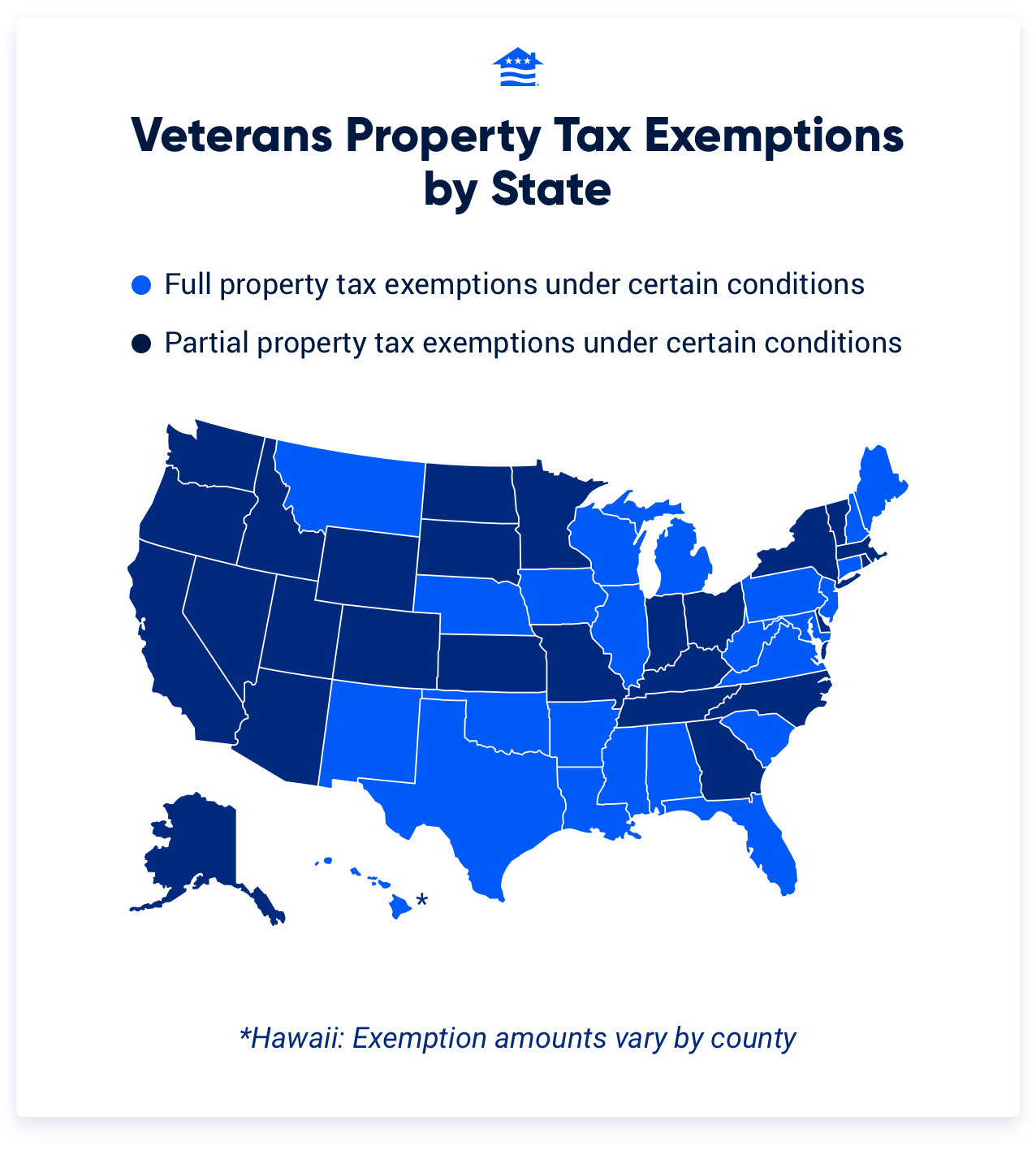

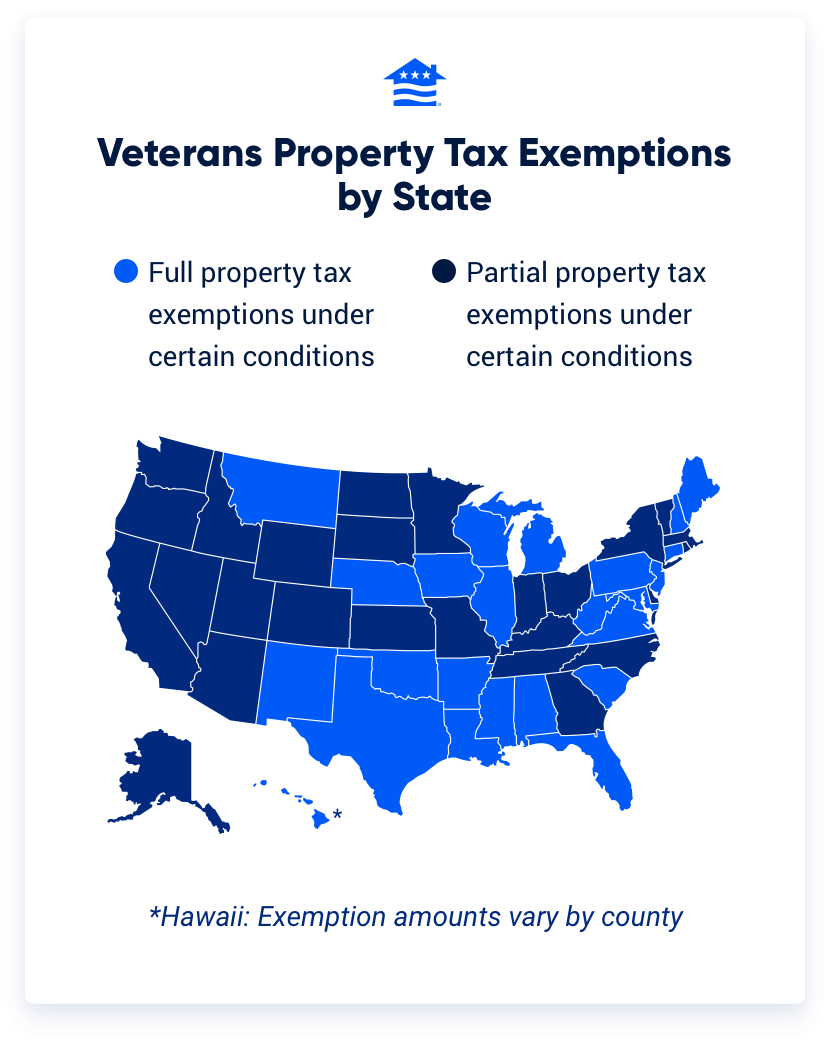

All U.S. states offer disabled Veterans some form of property tax exemption, though eligibility is usually contingent on meeting certain disability ratings.

Several states offer 100% disabled Veterans full property tax exemptions

States may require Veterans to renew their exemptions annually.

After a multi-year, nationwide effort to lessen the financial strain on qualified disabled Veterans, almost every state in the U.S. offers some sort of property tax exemption for disabled Veterans.

"If you're a disabled Veteran, in almost every single jurisdiction, you can petition your local taxing authority and you can have all of your local real estate taxes waived," said Mike Frueh, former National Director of the VA home loan program. "That's a fantastic benefit."

And that benefit could save you thousands on your property taxes.

Do Veterans Pay Property Taxes?

Veterans must pay property taxes unless exempt by their state’s property tax exemption laws.

Some Veterans — especially disabled Veterans — may be entitled to property tax exemption for their primary residence. Eligibility and the exemption amount typically depend on VA disability rating, state, county and city.

For example, some states limit exemptions to Veterans with a 100% VA disability rating, while others go as low as 10%. Many states even reduce property taxes for all Veterans, regardless of medical condition.

If your state offers a partial exemption, make sure to work closely with your county assessor, as most partial exemptions do not go into effect until the following year. This may cause a shortage on your escrow, which will cause your payment to temporarily be higher than the regular payment with taxes until the shortage is paid back.

Property Tax Exemptions by State

Here is a short summary of each state's property tax exemptions available to Veterans who qualify. To ensure you are eligible, click the link next to the summary to see your state's complete tax exemption requirements.

Exemption amounts, rates and conditions can vary by county or city just as they do by state. Veterans should contact their local municipal tax assessor's office to check for localized exemptions.

| State | Minimum Disability Requirement |

|---|---|

| Alabama | Disabled Veterans in Alabama may receive a full property tax exemption if they have a 100% disability rating or are over the age of 65. The property cannot exceed 160 acres and must be a single-family home listed as the Veteran's primary residence. Non-ad valorem taxes are not exempt. See all exemption requirements → |

| Alaska | Veterans with a disability rating of 50% or more may receive a property tax exemption up to the first $150,000 of the assessed value of their primary residence. The exemption may transfer to the spouse if the Veteran has passed and the spouse is at least 60 years old. See all exemption requirements → |

| Arizona | In Arizona, totally and permanently disabled Veterans may qualify for a property tax exemption of up to $4,188 on their primary residence. Veterans must be permanent residents of Arizona, and the property's assessed value cannot exceed $28,458. See all exemption requirements → |

| Arkansas | Disabled Veterans who have lost a limb or the use of a limb, are totally blind in one or both eyes or have a 100% disability rating can receive a full property tax exemption in Arkansas. The exemption is valid for all state taxes on the homestead and personal property owned by the disabled Veteran. Surviving spouses, as long as they remain unmarried, and dependent children during their minority, may obtain the exemption if the Veteran passes. See all exemption requirements → |

| California | Veterans with a 100% disability rating or who are compensated at the 100% rate due to unemployability, may qualify for a property tax exemption in California. In 2025, qualifying Veterans can receive a property tax exemption of up to $175,298 on the full value of their property or up to $262,950 for Veterans whose annual household income does not exceed $78,718. The property must be your primary residence. See all exemption requirements → |

| Colorado | Veterans with a 100% disability rating in Colorado may receive a property tax exemption of 50% of the first $200,000 of the full value of their primary residence. This property tax deferral applies to eligible Veterans over the age of 65 and active duty personnel. See all exemption requirements → |

| Connecticut | Connecticut provides a full property tax exemption for the dwellings of Veterans with a service-connected permanent and total (P&T) disability rating from the U.S. Department of Veterans Affairs. Tax bills reflecting this exemption will be issued in Fiscal Year 2026. Certain townships may have additional time in service requirements. See all exemption requirements → |

| Delaware | Veterans in Delaware with a 100% disability rating and who have held residency in Delaware for at least 3 years may be eligible for a tax credit against 100% of non-vocational school district property tax. See all exemption requirements → |

| Florida | Resident Veterans in Florida with at least a 10% disability rating are entitled to a $5,000 deduction on the assessment of their home for tax purposes. Resident Veterans in Florida with a 100% disability rating may receive a full property tax exemption. Other homestead exemptions may exist for Veterans over 65 years old and surviving spouses. See all exemption requirements → |

| Georgia | Disabled Veterans with a 100% disability rating in Georgia may receive a property tax exemption of up to $109,986 plus an additional sum from paying property taxes for county, municipal and school purposes, depending on a fluctuating index rate set by the U.S. Secretary of Veterans Affairs. The current amount is updated for 2025. See all exemption requirements → |

| Hawaii | Disabled Veterans in Hawaii may receive a full property tax exemption on their primary residence if they are 100% disabled due to service. Exemptions may vary based on which county the Veteran resides in. Click the links to see tax exemptions for Hawaii County, Honolulu County, Maui County and Kauai County. See all exemption requirements → |

| Idaho | Veterans with a 100% disability rating or who receive 100% compensation due to unemployability may reduce their property taxes by $1,500 in Idaho. The Veteran must own and live in the home as their primary residence before April 15, 2025. The property must have a current homeowner's exemption. Mobile homes are eligible. See all exemption requirements → |

| Illinois | Veterans and surviving spouses in Illinois may qualify for a property tax exemption. Veterans with a 70% disability rating or higher are eligible for a full property tax exemption on homes with an Equalized Assessed Value (EAV) lower than $250,000. Eligibility and exemption amounts can vary depending on other disability ratings, if the tax is for specially adapted housing and if the Veteran has recently returned from active duty in an armed conflict involving the United States armed forces. See all exemption requirements → |

| Indiana | In Indiana, Veterans who served in WWII, Korea, Vietnam or the Gulf War received an honorable discharge and have a disability rating of at least 10% qualify for a property tax exemption of $24,960 from the assessed value of the Veteran's property. Veterans who served in the military for at least 90 days, received an honorable discharge and have either a total service-connected disability or are 62 years old with a disability rating of at least 10% qualify for a deduction of $14,000 from the assessed value of the Veteran's property. |

| Iowa | Veterans with a 100% disability rating from service-connected causes or who have a permanent and total disability rating based on individual employability paid at the 100% disability rate qualify for a full property tax exemption in Iowa. There is no limit to the exemption amount, but only 1 property less than 40 acres in a rural area or less than 1/2 acre in an urban area may qualify. Surviving spouses may also receive the benefit if the Veteran has passed. |

| Kansas | Disabled Veterans may receive a property tax exemption on their primary residence. Qualifying residents can get a refund if they have a household income of $42,600 or less, and they must either be born before Jan. 1, 1969, be blind or totally and permanently disabled all of 2024 regardless of age, be a disabled Veteran or have a dependent child who lived with the Veteran the entire year who was born before January 1, 2024 and under the age of 18 the entire year. The maximum refund is $700. See all exemption requirements → |

| Kentucky | Kentucky Veterans who are at least 65 years old or totally disabled as a result of military service may receive a property tax exemption of up to $49,100 for their primary residence. This limit changes annually for inflation and is for the 2025 tax year. See all exemption requirements → |

| Louisiana | Veterans in Louisiana with a 100% service-connected disability rating or a 100% unemployability rating from the VA may receive a full parish property tax exemption. Veterans with a disability rating of 99% or less and their spouses may be eligible for a partial property tax exemption of up to $120,000 based on rating. See all exemption requirements → |

| Maine | Veterans who are at least 62 years old or have a disability rating of 100% (service or non-service-related) may qualify for a property tax exemption up to $6,000 in Maine. A Veteran who receives a federal grant for a specially adapted housing unit may receive an exemption of up to $50,000. See all exemption requirements → |

| Maryland | A Veteran who is 100% disabled due to service may qualify for a full property tax exemption on their primary property in Maryland. Surviving spouses of military personnel killed in the line of duty may also be eligible for this exemption. The Veteran must apply for the tax exemption with the county by September in order for the exemption to be applicable the following year. See all exemption requirements → |

| Massachusetts | Veterans in Massachusetts who have at least a 10% disability rating, lived in the state for 6 months prior to enlisting or lived in the state for five consecutive years may receive a property tax exemption. Local municipalities can vote on the level of exemptions offered. An exemption of $400 may be awarded if the Veteran is 10% or more disabled, a Purple Heart Recipient or a Gold Star parent. A $750 exemption may be awarded if the Veteran lost the use of one hand, one foot or one eye; $1,250 if the Veteran lost the use of both hands, both feet or a combination of the two; or if the Veteran is blind in both eyes as a result of service. A Veteran may receive a $1,500 exemption if 100% disabled as a result of service, or a full exemption for Veterans who have paraplegia or have 100% disability for service-connected blindness. See all exemption requirements → |

| Michigan | Michigan Veterans who are 100% disabled from service or who have a permanent and total disability rating based on individual employability may qualify for a full property tax exemption on their primary residence. Note that the application will be reviewed by a board and the Veteran must re-apply every year. The state also offers active military personnel a homestead tax credit and property tax relief. See all exemption requirements → |

| Minnesota | Veterans with at least a 70% disability rating may receive a property tax exemption of up to $150,000 in Minnesota. 100% disabled Veterans can qualify for a higher exemption up to $300,000. Surviving spouses of military personnel are eligible to receive a $300,000 exclusion. See all exemption requirements → |

| Mississippi | Any honorably discharged Veteran with a service-connected total and permanent disability is exempt from all property taxes on the assessed value of homestead property. Non-Ad Valorem taxes are not exempt. Unmarried surviving spouses of eligible Veteran homeowners may also qualify. See all exemption requirements → |

| Missouri | Veterans with a 100% disability rating in Missouri may receive a credit of up to $1,100 for property taxes on their primary residence. Former Prisoners of War also qualify for this exemption. See all exemption requirements → |

| Montana | Veterans and their spouses in Montana may receive a property tax exemption on their primary residence if the Veteran has a 100% disability rating. The exemption amount is based on income and marital status. See all exemption requirements → |

| Nebraska | Nebraska Veterans with a 100% disability rating may receive a property tax exemption on their home. The exemption is based on marital status and total household income. The Veteran must file a form 458 with the county assessor after February 1st and on or before Jun 30th each year. See all exemption requirements → |

| Nevada | A disabled Veteran in Nevada may receive a property tax exemption of up to $34,400 of the assessed value of their primary residence if the Veteran is 100% disabled as a result of service. Veterans with a disability rating between 60% and 79% are eligible for a $17,200 deduction, and Veterans with a disability rating of 80% to 90% qualify for a $25,800 reduction. See all exemption requirements → |

| New Hampshire | There is a $701 tax credit for an eligible permanently and totally disabled service-connected Veteran, double amputee or paraplegic or unremarried surviving spouse in New Hampshire. Cities and towns may vote to adopt a higher tax credit of up to $4,000. A permanently and totally disabled Veteran who is blind, paraplegic or a double amputee as a result of service connection and who owns a specially adapted homestead acquired with VA or with proceeds from the sale of any previous homestead acquired with VA assistance is exempt from all taxation on the homestead. The Veteran's surviving spouse is also exempt. See all exemption requirements → |

| New Jersey | A disabled Veteran in New Jersey may receive an annual tax exemption on their primary residence if they are 100% totally and permanently disabled during active duty service. Must be a legal resident of New Jersey, be honorably discharged and own and occupy the dwelling as a main home and residence. See all exemption requirements → |

| New Mexico | Veterans with a 100% disability rating in New Mexico will receive a full tax exemption if the disabled Veteran occupies their property and is the Veteran's principal place of residence. $4,000 of the home's taxable value may be tax-exempt for non-disabled Veterans. See all exemption requirements → |

| New York | Veterans may qualify for three different partial property tax exemptions in New York, including the Alternative Veterans’ Exemption, the Cold War Veterans’ Exemption and the Eligible Funds Exemption. Exemptions apply to county, city, town and village taxes. Getting a tax exemption is not automatic, and initial applications are often due on March 1st. See all exemption requirements → |

| North Carolina | North Carolina Veterans who either are 100% disabled or receive benefits for specially adapted housing under 38 U.S.C. 2101 can receive a property tax exemption of up to the first $45,000 of the appraised value of their primary residence. See all exemption requirements → |

| North Dakota | A disabled Veteran in North Dakota with at least a 50% disability rating is eligible for tax reductions ranging from $4,050 to $8,100, depending on their disability percentage. Paraplegic Veterans may receive a property tax exemption for the first $120,000 on their primary residence or if they have been awarded specially adapted housing. See all exemption requirements → |

| Ohio | In Ohio, 100% disabled Veterans may qualify for a property tax exemption on up to $50,000 of the market value of their primary residence. See all exemption requirements → |

| Oklahoma | An honorably discharged Veteran who is 100% disabled is fully exempt from paying ad valorem taxes on their primary residence. Surviving spouses of Veterans killed in active duty may also receive the exemption. See all exemption requirements → |

| Oregon | Disabled Veterans in Oregon may receive a property tax exemption if the Veteran has a 40% or more disability rating. The Veteran must own and live on the homestead property. Exemption amounts vary annually according to income and typically increase by 3% each year. For 2025, the exemption amounts are $26,303 or $31,565. Surviving spouses may also be eligible. See all exemption requirements → |

| Pennsylvania | Pennsylvania Veterans may be fully exempt from property taxes on their primary residence if the Veteran has a disability rating of 100% due to service-related causes. To receive the exemption, Veterans must show financial need. Those with an annual income below $114,637 are given a presumption of need for the exemption. Veterans with a gross annual income above $114,637 are considered to have a financial need for the exemption when their monthly expenses are more than their monthly household income. See all exemption requirements → |

| Rhode Island | Disabled Veterans may receive a property tax exemption on their primary residence in Rhode Island. Exemption amounts vary by county, the value of the property and the exemption category the Veteran falls into. The 7 categories are Veterans' regular exemption, Partially Disabled Veteran, Totally Disabled Veteran, Unmarried Widow of Qualified Veteran, Gold Star Parents' exemption, Prisoner of War exemption and Specially Adapted Housing exemption. See all exemption requirements → |

| South Carolina | Veterans determined to be totally or permanently disabled from wartime or due to individual unemployability may receive a property tax exemption on their home and land up to 5 acres. South Carolina also provides a property tax exemption on up to 2 vehicles for 100% disabled Veterans. Others who may qualify include Medal of Honor recipients, former Prisoners of War and surviving spouses of eligible Veterans. See all exemption requirements → |

| South Dakota | Permanently disabled Veterans may qualify for a property tax exemption of up to $200,000 on their home in South Dakota. The Veteran must have a disability rating of 100%, and the home must be occupied as the Veteran's primary residence. Paraplegic Veterans are eligible for a full property tax exemption. See all exemption requirements → |

| Tennessee | Tennessee provides property tax relief for disabled Veteran homeowners or surviving spouses. The Veteran must be rated permanently and totally disabled and occupy the home as their primary residence. The maximum market value on which the tax relief is calculated is $175,000. See all exemption requirements → |

| Texas | Veterans in Texas may qualify for a property tax exemption depending on their VA disability rating. Veterans with a 100% disability rating are fully exempt from property taxes. 70% to 99% may receive a $12,000 exemption from their property's taxable value. 50% to 69% may receive a $10,000 reduction from the property's value. 30% to 49% may receive a $7,500 exemption from the property's value. 10% to 29% may receive a $5,000 exemption from the property's value. Texas does not allow the Veteran to receive cash from the seller’s tax proration at closing. This must be applied toward principal reduction or closing costs. See all exemption requirements → |

| Utah | Veterans with a service-connected disability rating of at least 10% may qualify for a property tax abatement in Utah. The specific reduction is determined by the Veteran's disability rating with a maximum exemption amount of $275,699 for 100% service-connected disability. The amount is then subtracted from the taxable value of your primary residence. See all exemption requirements → |

| Vermont | Veterans with a disability rating of at least 50% may qualify for a property tax exemption on their primary residence in Vermont. The exemption is also available for Veterans who qualify for VA pension and military retirement pay. Vermont mandates a minimum property tax exemption of $10,000 for Veterans in the municipal and education grand list, though local municipalities may vote to increase this to $40,000. Surviving spouses and children of a disabled Veteran are also eligible as long as they occupy a primary residence in Vermont. This exemption is separate from the Department of your Homestead Declaration and Property Tax Credit Claim. See all exemption requirements → |

| Virginia | Permanently and totally disabled Veterans in Virginia or Veterans who have a permanent and total disability rating based on individual unemployability paid at the 100% disability rate may qualify for a full property tax exemption on their primary residence. This exemption may only be applied to properties with up to an acre of land. Surviving spouses may also be exempted if they remain unmarried and occupy the primary residence. Veterans must apply for the tax exemption with the county between January 1st and March 31st of the year. See all exemption requirements → |

| Washington | Washington provides property tax relief for Veterans with a disability rating of 80% or higher. The relief amount is based on income, the value of the residence and the local levy rates. Widows of disabled Veterans are also eligible. See all exemption requirements → |

| West Virginia | West Virginia offers a property tax credit to eligible honorably discharged Veterans from any Armed Services branch who are considered 90% to 100% disabled by the VA. Only eligible Veterans who are owners of a homestead that is used or occupied exclusively for residential purposes may claim the tax credit. This benefit applies to mobile, manufactured and modular homes as well. The location and contact information of your county assessor can be found at tax.wv.gov. See all exemption requirements → |

| Wisconsin | Wisconsin provides a property tax credit for Veterans with a 100% disability rating who have lived in the state for at least 5 years or lived in Wisconsin when starting their service. The property must be the Veteran's primary residence and only an acre or less. Unmarried surviving spouses are eligible as well. See all exemption requirements → |

| Wyoming | Honorably discharged Veterans in Wyoming may be eligible for a property tax exemption of $6,000 of the assessed value of their primary residence, depending on where they served or medals received. Veterans must have lived in Wyoming for at least 3 years to qualify. If the Veteran or surviving spouse does not use the exemption, they can apply the amount to their vehicle's license fee. See all exemption requirements → |

| District of Columbia | A Veteran must have a 100% disability rating to qualify for a property tax exemption in the District of Columbia. The exemption is limited to a $445,000 value, and the Veteran's household must be defined as eligible based on income and other factors. Veterans must complete and file with the District of Columbia Office of Veterans Affairs to receive the exemption. See all exemption requirements → |

How Disabled Veteran Property Tax Exemptions Work

A property tax exemption reduces the assessed value of your home, which lowers the amount of property tax you owe. Generally, the exemption amount is subtracted from the assessed value of your home. So, for example, if your home is worth $100,000 and your exemption amount is $2,000, you’ll be taxed for $98,000 instead of the full $100,000.

Property tax exemptions for disabled Veterans work differently depending on the state and county you live in. But, the process generally follows these steps:

1. The VA Assigns You a Disability Rating

The VA assigns a disability rating based on the severity of the Veteran’s service-connected condition. Service-connected condition means that the condition started or was aggravated due to service. Disability ratings are on a scale of 0% to 100% and are assigned in 10% increments. 100% is the highest rating.

There are two ways that a Veteran can receive a 100% disability rating:

- The Veteran has one service-connected condition that meets the 100% rating

- The Veteran has multiple service-connected conditions (aka a “combined rating”) whose individual ratings add up to 100%

Once the disability rating is received, you’re then free to apply for the exemption.

2. You Apply for a Property Tax Exemption with Your State

Once you’ve been approved for VA disability, it’s time to apply for the property tax exemption based on your county and state’s specific requirements. The application will usually be found via your county tax assessor’s office and/or website. This application will generally require at least the three following documents:

- VA Disability Rating Letter

- Proof of Residency

- Identification

Some states may require additional forms or affidavits. Your county tax assessor should be able to guide you on your requirements.

3. Your Application is Processed and Implemented

Next, the assessor will process the application. If the application is approved, you will receive a notice of approval from the tax assessor’s office. This may include information about the exemption amount and how that exemption will be applied.

4. Your Exemption Takes Effect

Generally, the approved exemption amount will be applied to your property tax bill, reducing the amount that you owe on property taxes.

5. You Annually Renew if Necessary

Some states may require annual renewals or recertifications to maintain the exemption. Your county tax assessor should be able to help you with this process if needed.

Can You Claim Multiple Exemptions at Once?

Depending on where you live, it is often possible to claim multiple property tax exemptions simultaneously. Combining multiple tax exemptions can further reduce your taxable property value, saving you even more money. Common exemptions include:

- Exemptions for seniors

- Primary residence (homestead) exemptions

- Exemptions for certain income levels

There may be rules about how these exemptions interact and whether they can be fully combined or if limits apply. For example, some states allow the full amount of each eligible exemption to be applied to your property tax, while others may only allow the highest single exemption.

What to Remember

Every state offers at least some kind of partial tax exemption for disabled Veterans. However, every homeowner's situation is different. Here are some important things to remember about property tax exemptions:

- Common property tax exemptions include Veteran, Disabled Veteran, Homestead, Over 65 and more. Depending on where you live, you may be able to claim multiple property tax exemptions.

- Not all Veterans or homeowners qualify for these exemptions.

- Exemptions can vary by county and state.

- You may be required to renew your exemption benefits annually.

Take Advantage of Your Veteran Benefits

If you’re shopping for a new home and want to use your disabled Veteran property tax exemption on your new purchase, contact a Veterans United loan specialist at 855-870-884 or get started online today. They can walk you through the complete VA loan process for your purchase and provide tax exemption guidance after your purchase.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

May 22, 2025

Written BySamantha Reeves

Reviewed ByDon Wilson

Updated each state's property tax exemption laws for Veterans for 2025. Edited additional content and provided visualization. Reviewed by underwriter.

Related Posts

-

What Is The VA Seller Concession Rule?When buying a home with a VA loan, one potential way to save money is by negotiating seller concessions. Seller concessions are financial incentives or contributions from the seller that help reduce the buyer's out-of-pocket expenses. The Department of Veterans Affairs (VA) allows these concessions to cover up to 4% of the loan amount, but they must be items outside of standard closing costs.

What Is The VA Seller Concession Rule?When buying a home with a VA loan, one potential way to save money is by negotiating seller concessions. Seller concessions are financial incentives or contributions from the seller that help reduce the buyer's out-of-pocket expenses. The Department of Veterans Affairs (VA) allows these concessions to cover up to 4% of the loan amount, but they must be items outside of standard closing costs. -

How Discount Mortgage Points Work on a VA LoanPurchasing discount points on a VA loan can be a good investment for Veterans looking to lower their interest rate.

How Discount Mortgage Points Work on a VA LoanPurchasing discount points on a VA loan can be a good investment for Veterans looking to lower their interest rate.